How Do Director’s Loans Work?

Most director’s loans Ireland are short-term and interest-free. When a company lends money to a director, the transaction is logged as a liability in the company’s books. Under director’s loan repayment terms, the loan should typically be repaid within 12 months of the end of the accounting year.

If the loan is not repaid on time or at commercial terms, it may be considered a benefit in kind, triggering additional tax liabilities.

- Revenue may charge tax on unpaid loans

- Director loan interest rate must reflect market conditions

- Director’s loan benefit in kind applies to low or zero-interest loans

To avoid penalties, directors must pay tax on director’s loan values when applicable and comply with director loan risk and compliance rules.

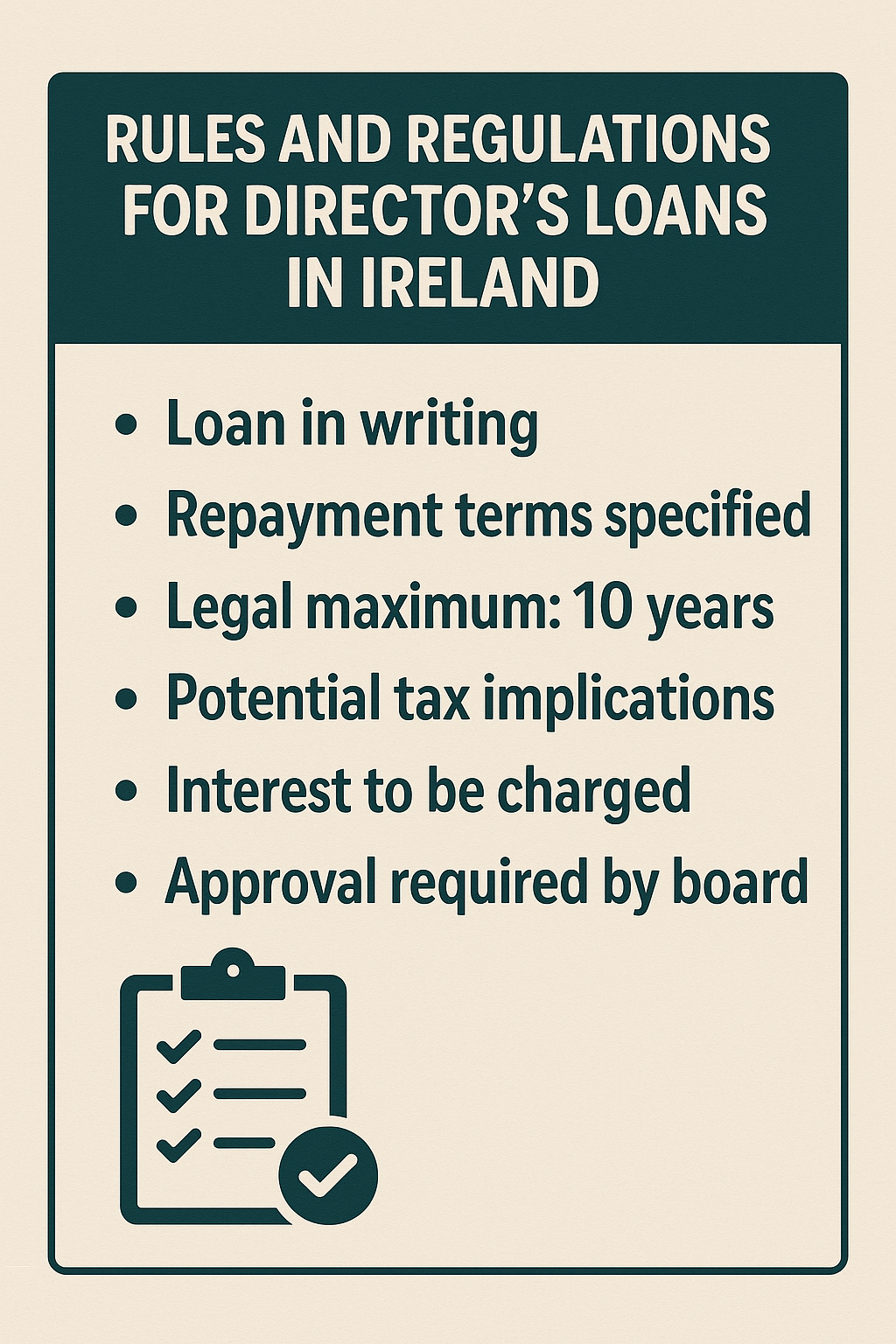

Rules and Regulations for Director’s Loans in Ireland

Strict legal and financial regulations govern the use of director’s loans in Ireland. These rules are meant to protect shareholders, creditors, and the integrity of the company.

- A company advance to director must be approved via a resolution or permitted in the articles of association

- The loan must be made under commercial terms, similar to a third-party loan

- A formal director’s loan agreement should be drawn up outlining repayment, interest, and terms

Failing to follow these rules can trigger restricted directors’ loan charges and increased Revenue scrutiny.

- Maintain detailed director’s loan account records

- Comply with loans to directors compliance Ireland

- Ensure correct director’s loan accounting treatment

- Monitor director’s loan deadlines ROS

Tax on Director’s Loan Ireland

Understanding the director’s loan tax treatment Ireland is crucial for avoiding penalties. If a director fails to repay the loan in full within 12 months, the company may face a tax surcharge under Section 239 of the Taxes Consolidation Act.

- Benefit in kind taxation for interest-free loans

- 20% surcharge on overdrawn director’s loan balances

- Director may have to pay tax on director’s loan value as additional income

If the director loan interest rate is below Revenue’s specified BIK rate (currently 8% in 2025), the director may owe extra income tax, and the company may owe employer’s PRSI.

Director’s Loan Agreement

A clearly written director’s loan agreement is essential for compliance and transparency. It should include:

- The loan amount

- Director’s loan repayment terms

- Interest rate charged

- Schedule and method of repayment

- Legal remedies in case of default

Having an agreement in place demonstrates proactive director loan risk and compliance practices and can protect both the company and the director.